Technical Analysis of EURUSD and GBPUSD: Short-Term Rally May Continue as Dollar Looks for Upside Catalysts

The EUR/USD pair made modest gains during the early European session, buoyed by unrevised German inflation data that fell in line with expectations, registering a 2.5% year-on-year increase. This minor uptick comes in anticipation of the upcoming US CPI inflation data, a pivotal event that could potentially sway market sentiments.

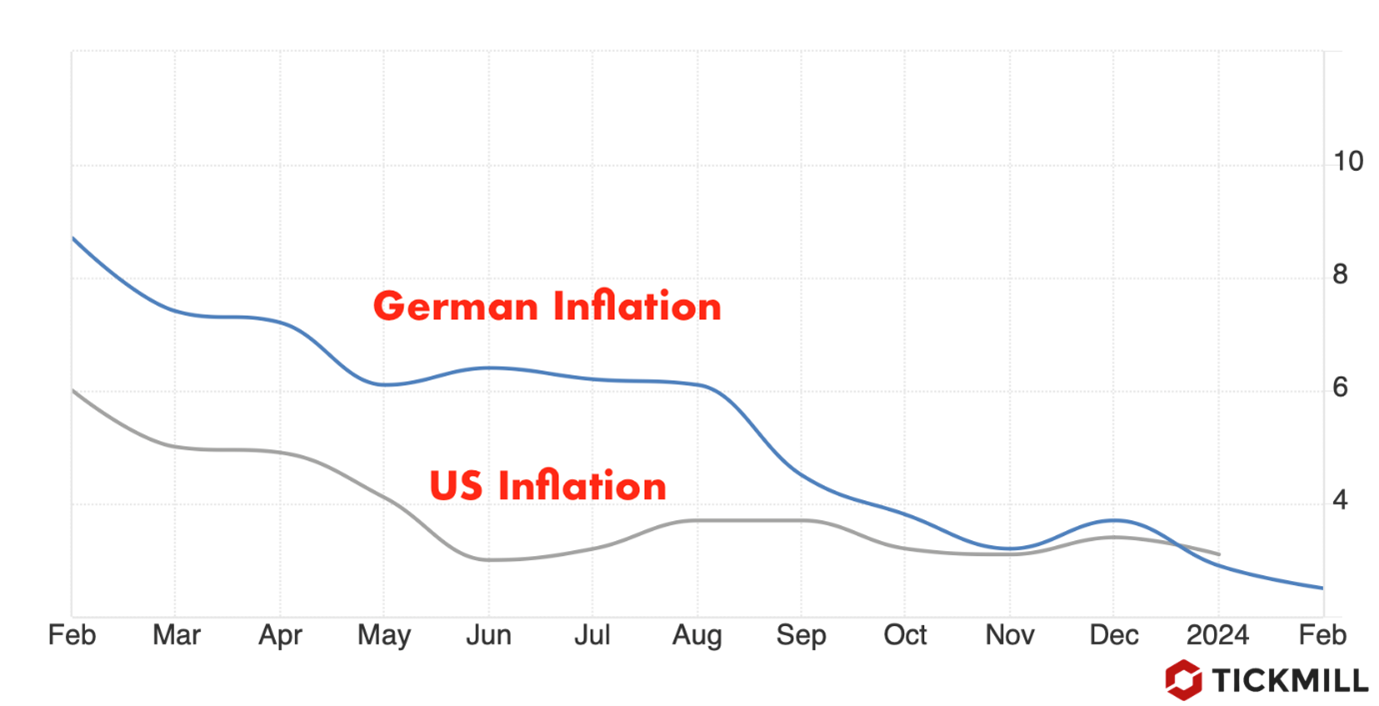

The chart below indicates that even though the German inflation rate was significantly higher in the early months of last year, its convergence with the US rate was primarily driven by its quick fall and the relative stability of the US one. The momentum continued into 2024 as well, which poses some risks for the Euro as the ECB will likely initiate an easing cycle earlier than the Fed on the back of this trend:

Traders are currently fixated on the impending release of US CPI figures, particularly the Core CPI, which excludes volatile food and energy prices. Market consensus suggests a moderation to 3.7% year-on-year in February, down from January's 3.9%, with a monthly gain of 0.3%. Meanwhile, the headline CPI is forecast to remain unchanged at a 3.1% year-on-year rise, coupled with a 0.4% monthly increase.

Amidst this anticipation, futures on the federal funds rate provide insights into market sentiment regarding potential Federal Reserve policy actions. Probability estimates indicate a mere 3% chance of a rate cut in March, while probabilities for one or more cuts by June soar to 71.4%, signaling evolving expectations of monetary policy adjustments.

The recent market dynamics have been influenced by contrasting perspectives within the European Central Bank (ECB), notably highlighted by Banque de France Governor François Villeroy de Galhau and Bundesbank President Dr. Joachim Nagel, who advocated for a potential rate cut in the spring.

Technically, the EUR/USD pair appears poised to test the upper boundary of a medium-term bearish channel, presenting an opportune juncture for recent buyers to secure profits, potentially triggering a short-term rally towards 1.1050. However, this anticipated upswing may be followed by a retracement, with a conceivable bearish target at the 1.08 level:

Meanwhile, the GBP/USD pair faced bearish pressures on Monday, succumbing to negative market sentiment amidst a focus on US inflation data. The UK's Office for National Statistics reported a rise in the ILO Unemployment Rate to 3.9% and a decrease in Employment Change by 21,000 in January, alongside a slight dip in annual wage inflation to 6.1%. These factors contributed to the Pound Sterling's struggle against the US Dollar, further compounded by shifting risk moods.

The technical picture of the GBPUSD shows that the price struggles to capitalize further on its powerful breakout of an important descending resistance line, which has been suppressing the Pound’s upside since December last year. Momentum has been faltering for the second day in a row, which adds to the risk that the pair may first retreat towards the confluence area of support and previous resistance levels (1.27) before it starts to draw more attention from the buyers:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.