Should We Rush to “Buy the Dip”? Emerging Market ETFs Call for Caution

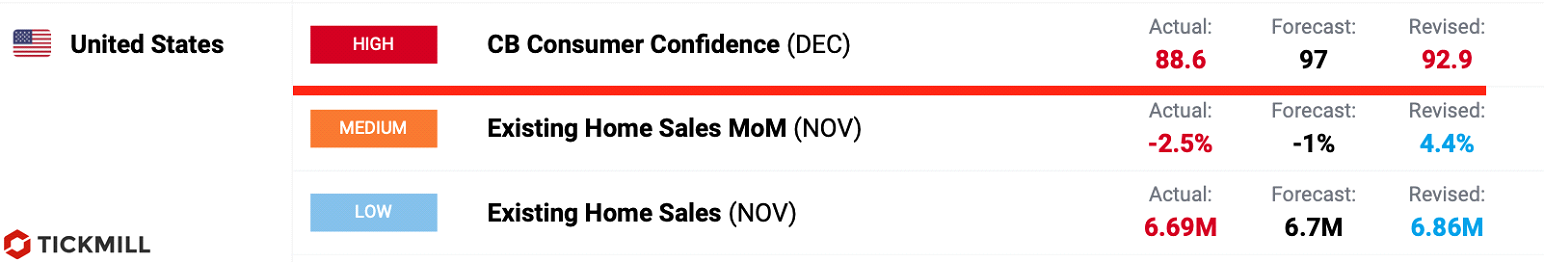

The US economy is likely to experience a material slowdown in consumer spending (key component of the GDP) in the coming month. This was indicated by the monthly consumer confidence update from Conference Board which, contrary to expectations of a pickup, dived in November:

The data puts reflation trade under even more scrutiny, as the slack in spending increases reliance of consumption on government stimulus, which hasn’t been approved yet.

The data on existing home sales for November is also upset as sales contracted -2.5% vs. -1% forecast. The boom in construction and mortgages that we saw in the third and beginning of the fourth quarter, which represented a good part of the US post-crisis economic momentum, apparently started to peter out.

Regarding the fiscal deal, Trump refused to sign the bill which, after months of debates received bipartisan support; requesting some odd amendments that, if successful, would help him to score heaps of political points. On Tuesday he said that the Congress should increase stimulus checks to $2,000 per person, instead of "ridiculously low" $600 as well as cut over-funding of foreign and unnecessary projects.

If Trump blocks the bill then Congress will have time until December 28 to make all necessary changes (until that date, temporary operation of the government has been funded).

Markets were not particularly impressed by Trump's populist objection as, during months of debates he was silent, and then suddenly “woke up” after losing the election. A veto outcome is unlikely because it looks like Trump is putting on a show to demonstrate his battle against Congress to boost stimulus payments.

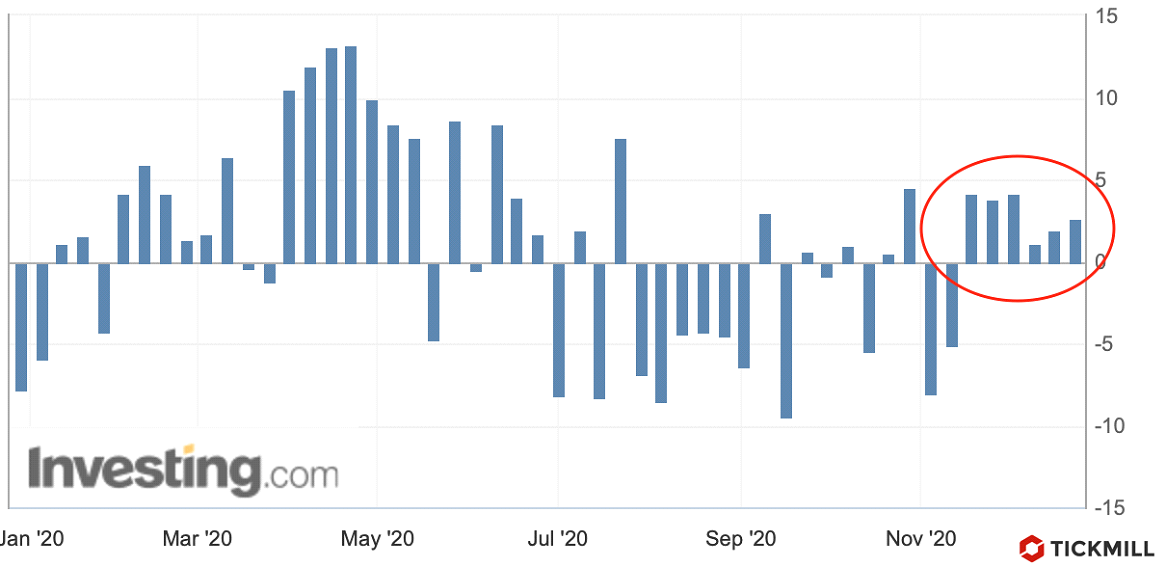

Regarding the pullback in equity markets, capital flows from/to emerging markets (the leading indicator now) continue to call for a patience. Investors have been actively quitting emerging market assets for the past two days, without signals of return. Two large ETFs that invest in emerging markets experienced a sharp outflow that drove price below key trend channel and targets 200-hour SMA. Not a very good technical signal:

In early November, in a similar technical juncture, the markets were rescued by vaccine news and Biden's victory.

Key news on coronavirus theme:

- France restored air travel with Britain.

- The CDC and the vaccine makers argue that, apart from the increased transmission rate, the new strain is no different from current strains.

In general, the headline on the topic is neutral-positive.

Oil prices are under pressure and it looks like it will be much more difficult to extend upturn. US oil inventories have been rising consistently (for 6 consecutive weeks), according to the API data:

Oil market expected to see -3.25M drawdown, but contrary to expectations, inventories rose by 2.7M. Taking into account new demand shock in Europe due to prolonged lockdowns, oil prices will probably hang out in the current range for some time.

US inflation report is slated for today as well as durable goods orders. A modest acceleration of inflation is expected from 1.4% to 1.5% and a slowdown in the growth of orders for durable goods - from 1.3% to 0.6%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.