Russian Ruble Should Drop Anytime Soon!

Good day!

The USD/RUB went down, seemingly working through a reverse flag pattern. However, the asset is yet to break the 62.48 support level. Once it’s broken, the asset could drop significantly:

Latest reports by COT CFTC show that large operators keep expanding their long positions when it comes to Russian ruble. Moreover, 32,455 contracts have been made as large operators bet on the Russian ruble’s price growth. It is also worth noting that, positions of the market players are at historical maximums, starting from 2009 or since the Russian ruble-related statistics has been kept. Yet there is a great risk that traders might start getting rid of the Russian ruble. This could drive a powerful jump in the price of the USD/RUB against dropping oil, tough sanctions or any other geopolitical events:

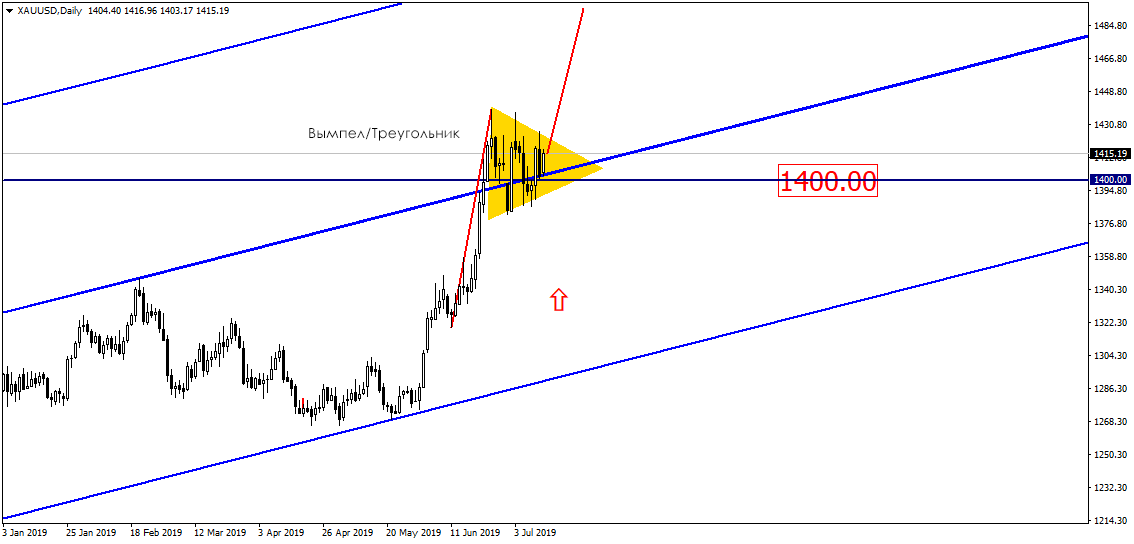

Gold remains at the 1400 level, forming a triangle in the daily chart. Yet, this triangle could even become a pennant with an unusually large body. We could assume that gold may jump anytime soon:

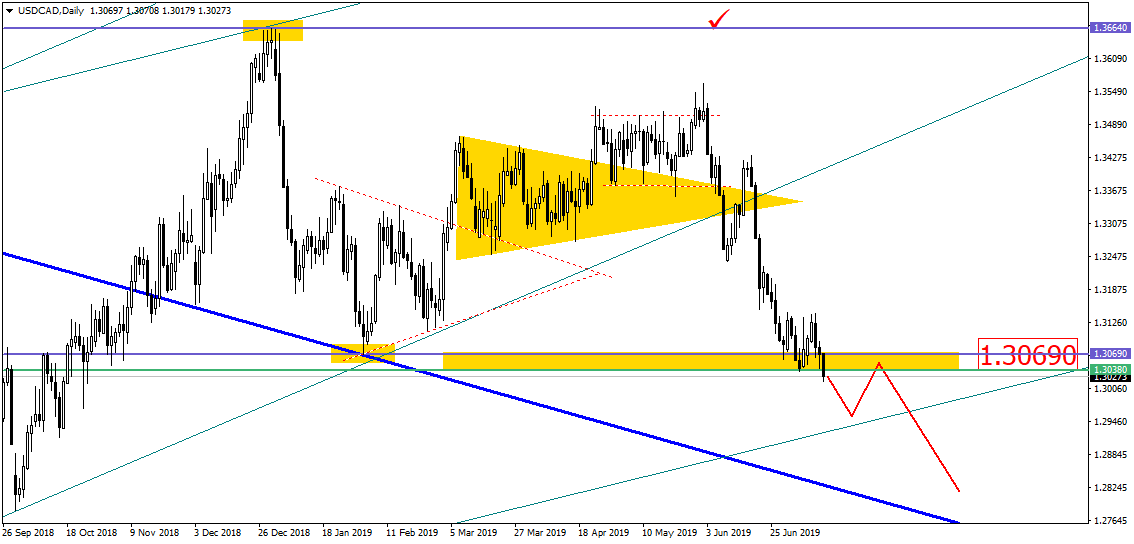

The Canadian currency broke the 1.3069 support level, thus targeting the rates of about 1.2900. Next to this value the asset’s price could get a very strong support from the weekly uptrend. So far, it seems feasible that the currency pair could drop smoothly:

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.