Incoming US Economic Data Hints the Fed will not Bend to Bearish Market Sentiment

A raft of US economic data for the first quarter, including surprising quarterly decline in GDP, sowed the seed of doubt in the market that the economy could withstand a series of aggressive Fed rate hikes and not slide into recession. However, incoming data for the second quarter consistently rebutted these fears, which helped risk assets to stabilize and Treasury yields to rise again, reflecting decline in demand for defensive assets. The US labor market remains in good shape, households maintain a solid pace of consumption, and the difficulties faced by the US manufacturing sector and construction were not as serious as previously thought.

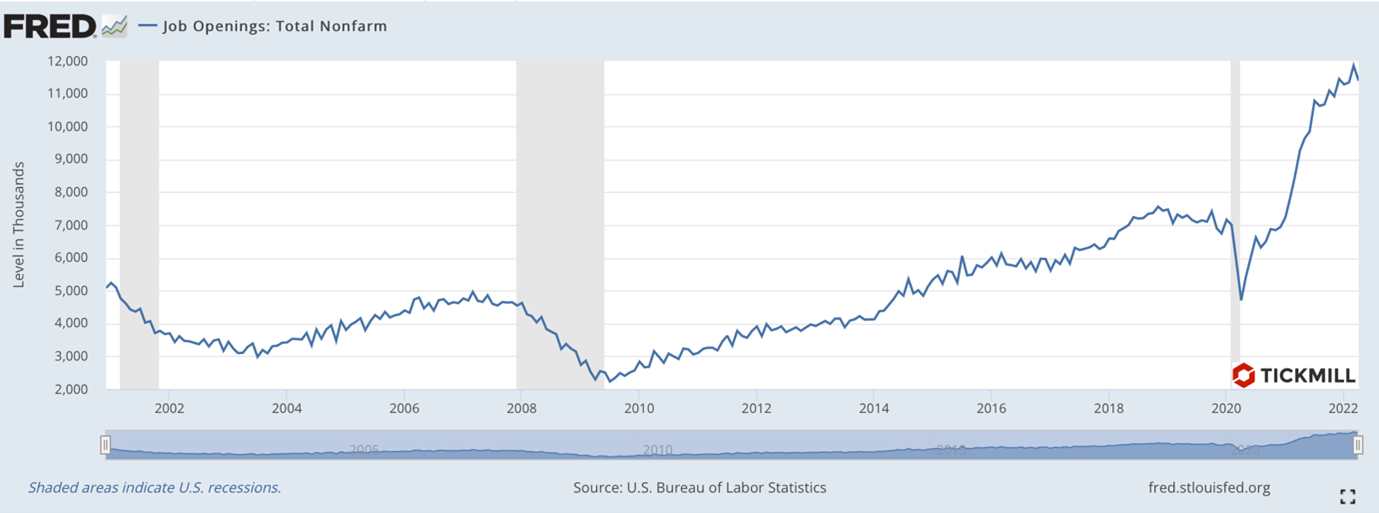

Yesterday's JOLTS report highlighted that the gap between labor demand and supply remained wide in May, so if Friday's NFP report points to weak job growth in May, markets could again attribute it to problems matching labor supply to demand rather than to weakening demand for labor force. As a result, the focus will once again be on wages as the main proxy for the dynamics of consumer income and, consequently, consumer spending. The latter indicator directly affects consumer inflation. The number of open vacancies, according to the report, decreased from 11.855 to 11.4 million (consensus 11.35 million):

However, given the number of unemployed, this means that there are two vacancies for every unemployed American. For comparison, in the UK there is one vacancy per unemployed person, and in Germany - only 0.4.

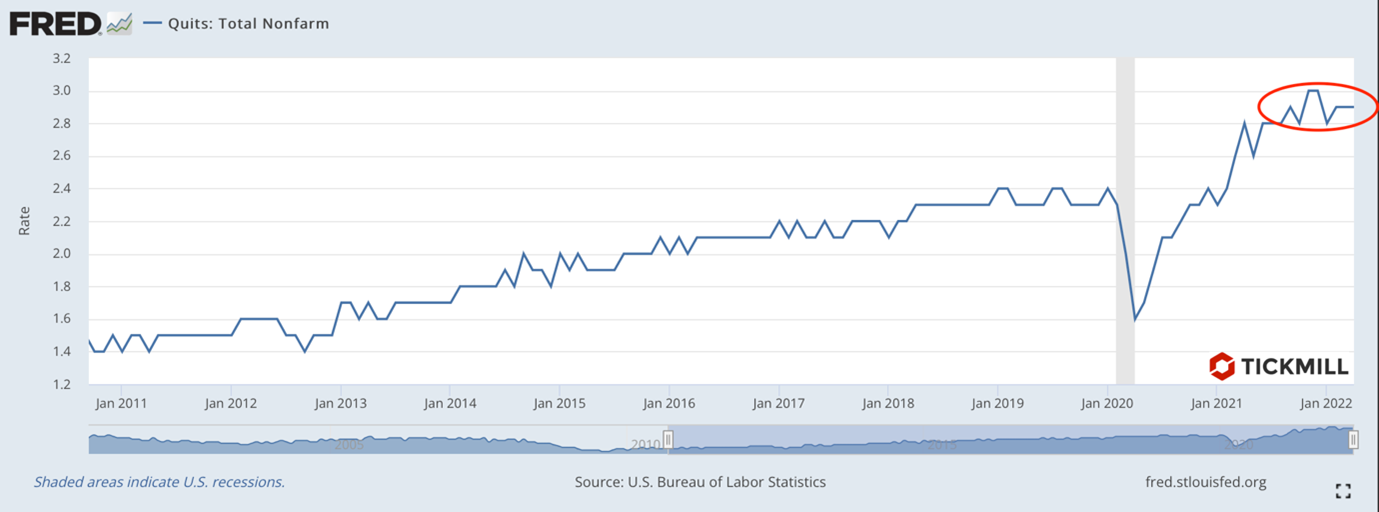

One of the leading indicators of shortages in the US labor market is the rotation of the labor force, i.e. the rate of layoffs, remained at a fairly high level for the third month in a row - 2.9%. This indicator is one of the key proxies of the bargaining power of employees, which directly affects the dynamics of wages.

The continued deficit in the labor market provides upward pressure on wages. As it is one of the main pro-inflationary factors, inflation is expected to remain robust and slowly return to the Fed's 2% target. As a result, the chances that the Fed will change its rhetoric remain low. At the same time, this cannot be said for the central banks of the European continent, where imports remain the main factor in inflation, and a too aggressive pace of policy tightening could provide a critical mass for a recession.

US manufacturing data beat expectations, with the ISM unexpectedly up from 55.4 to 56.1 (consensus 54.5). There were expectations in the market that weak data on the Chinese economy and an ambiguous picture given by regional indices would most likely lead to a decrease in the ISM index, however, the details showed that the index of new orders unexpectedly rose (from 53.5 to 55.1 points), as well as the index of production (from 53.6 to 54.2 points). The rest of the sub-indices indicated that inflationary pressures remain in supply chains.

With Chinese manufacturing activity indexes leading the US ISM indices, the easing of lockdown restrictions in China raises the possibility of a positive surprise in US data in the coming months.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.