EURUSD Gaps Higher on French Election Results

EUR Rallies on Monday

EURUSD is starting the week on a stronger footing with the pair gapping above the 1.0724 level at the open. The move comes in response to news that Marine Le Pen’s far-right party won the most votes in the first round of the French presidential elections, but not enough to secure a majority. Given the National Rally’s plans to increase spending at a time when the French budget is a major cause for concern for the European Commission, yesterday’s results have been seen as a net positive.

EUR Impact

Alongside the economic impact of the results, the prospect of a multi-party government should protect France and the EU from the more nationalist agenda of Le Pen’s party. Fears of a so-called ‘Frexit’ are a major concern should Le Pen’s party win outright power. In that scenario, EUR is likely to come under heavy selling pressure as traders assess the fall-out risk cross the EU. However, with such a majority now looking highly unlikely, the EU should be protected from such an event, maintaining the integrity of the single customs union.

2nd Round Voting

Focus now shifts to the next round of voting on July 7th. The big risk is that far-right supporters will be emboldened by these initial results, leading to a bigger turnout and a bigger show of support. Still, while a NR majority is avoided, EUR should remain supported near-term. particularly if we see any fresh weakness in USD this week.

Technical Views

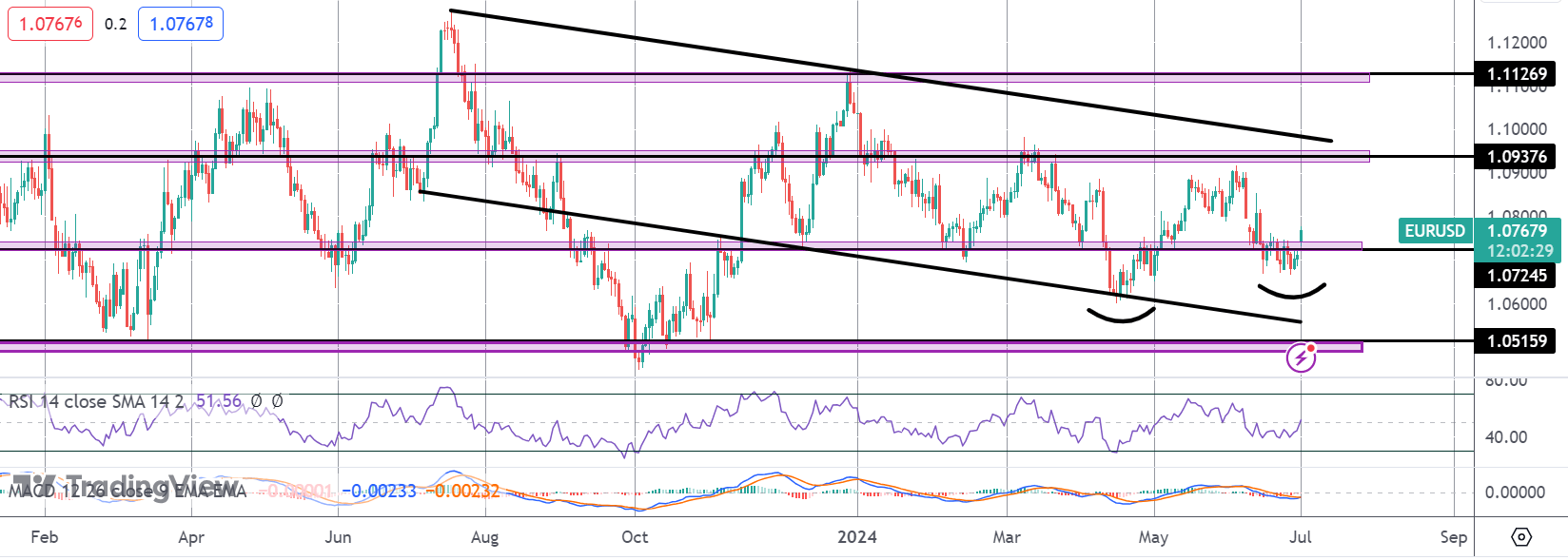

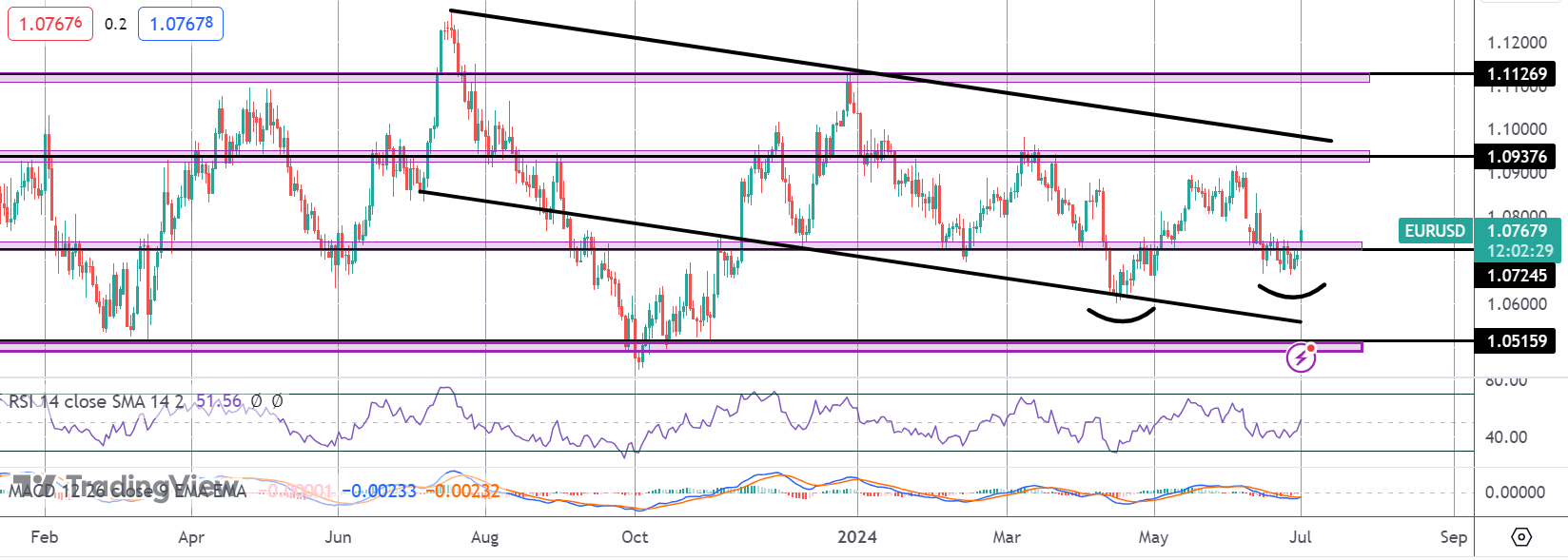

EURUSD

The pair is potentially carving out a double bottom (higher low) with the rally back above 1.0724. Momentum studies are turning higher here and if price can hold above this level, focus is on a continuation higher and a test of the 1.0937 level next with the bear-channel highs coming in just above.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.