EURUSD: ECB & US CPI on Watch

September ECB Meeting

Price action in EURUSD has been relatively unexciting recently, however this could be set to change today with two key events to monitor. First, the ECB will meet for its September rates setting meeting. No further easing is forecast today and instead, risks are skewed towards the ECB taking a more hawkish tone. The ECB recently signalled that it was likely approaching the end of its easing cycle and with core CPI recently seen rising above forecasts, there is chance that the end of the cycle is already in. Should the ECB take a more hawkish tone today, focusing on upside inflation risks and signalling an extended hold in rates, this could see EUR rallying today.

US CPI

Following on from that meeting, traders will then be turning their attention to the upcoming US CPI report due this afternoon. Current forecasts are for annualised CPI to have risen to 2.9% from 2.7% last month. However, on the back of yesterday’s heavy downside surprise in PPI, dovish risks are seen. Should CPI undershoot forecasts today, this will be firmly bearish for USD as traders ramp up easing expectations across the remainder of the year. In this scenario, coupled with a hawkish ECB meeting, EURUSD could well test highs by the end of the week.

Technical Views

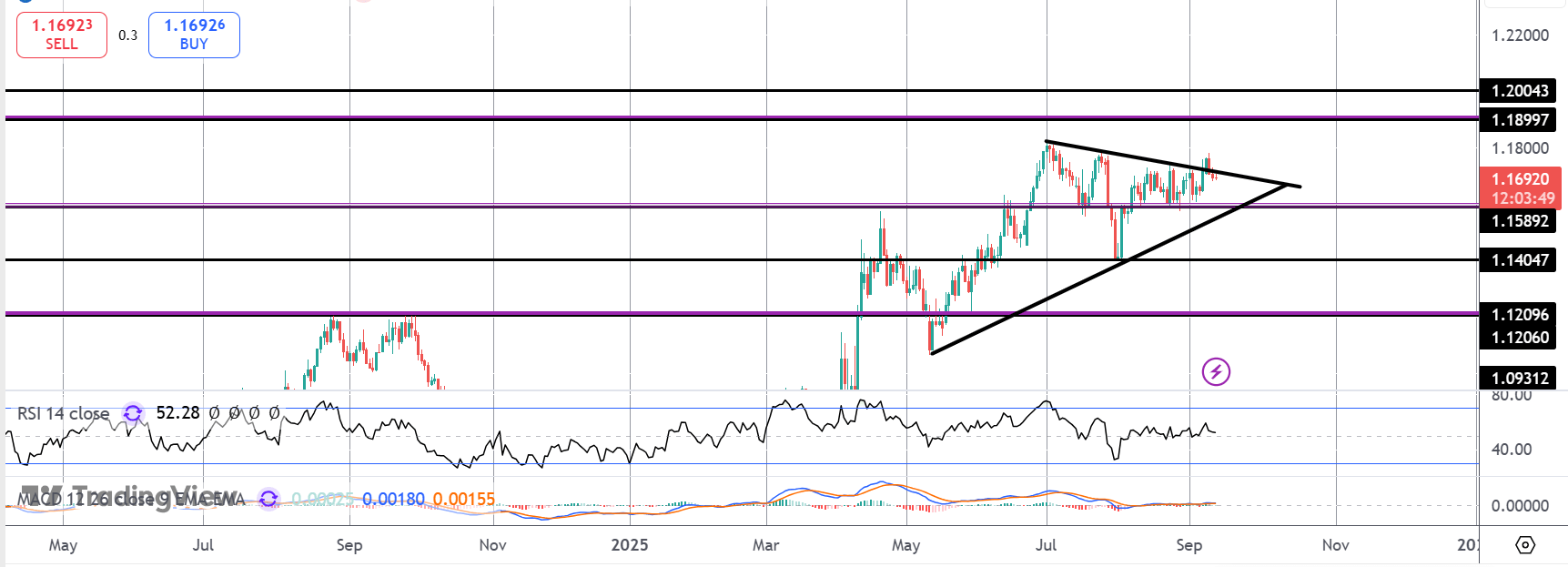

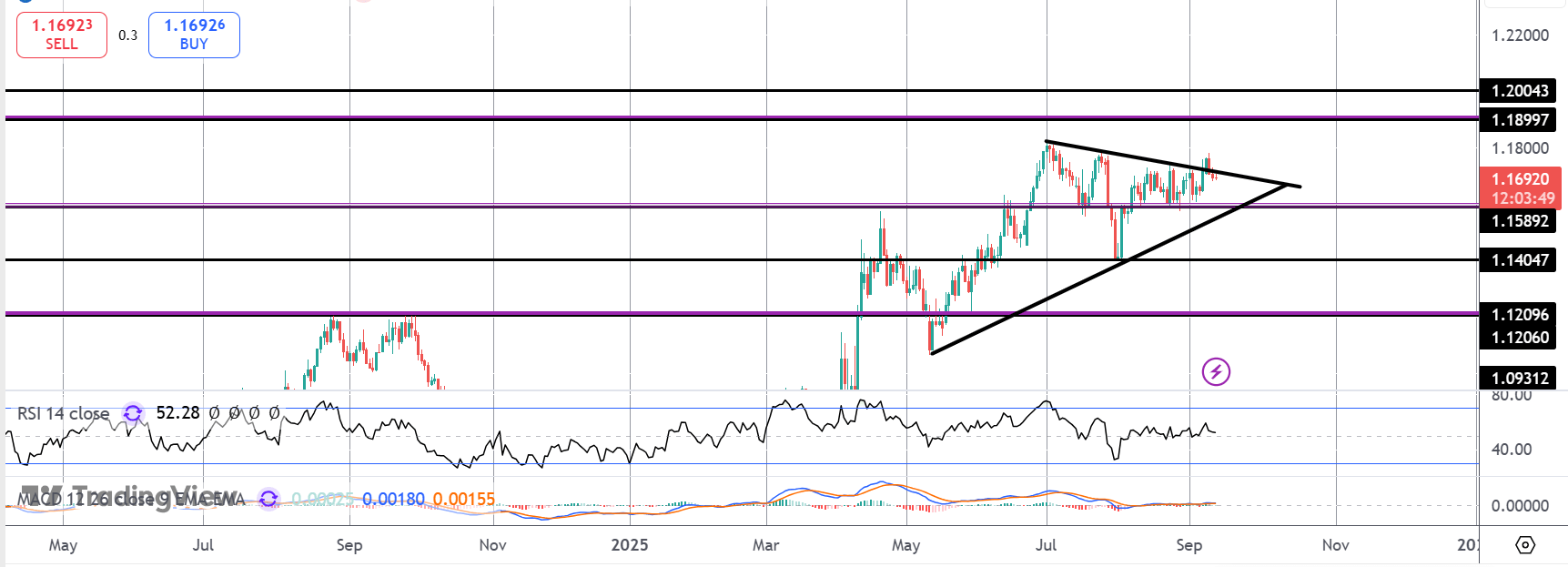

EURUSD

For now, the pair has settled back into the triangle formation following a false break on Monday. While above 1.1589, focus is still on an eventual upside break with 1.1899 and 1.20 the next bull targets to note. Below 1.1589, focus turns to 1.14 as the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.