Demand for Risk Seems to Hit Ceiling Before Powell's Speech

The wave of risk-on that swept markets in the first two days of the week apparently ebbs. Dollar rebounded, commodities struggle to extend the bounce, bond yields ticked higher while equity markets stay range-bound after the biggest short squeeze in several months. Despite apparent persistence of “buy-the-dip” mood things could go sour quickly if Powell hints in Jackson Hole that the Fed inches closer to tapering as early in the week, we saw markets working hard to price in dovish bias in the Powell speech.

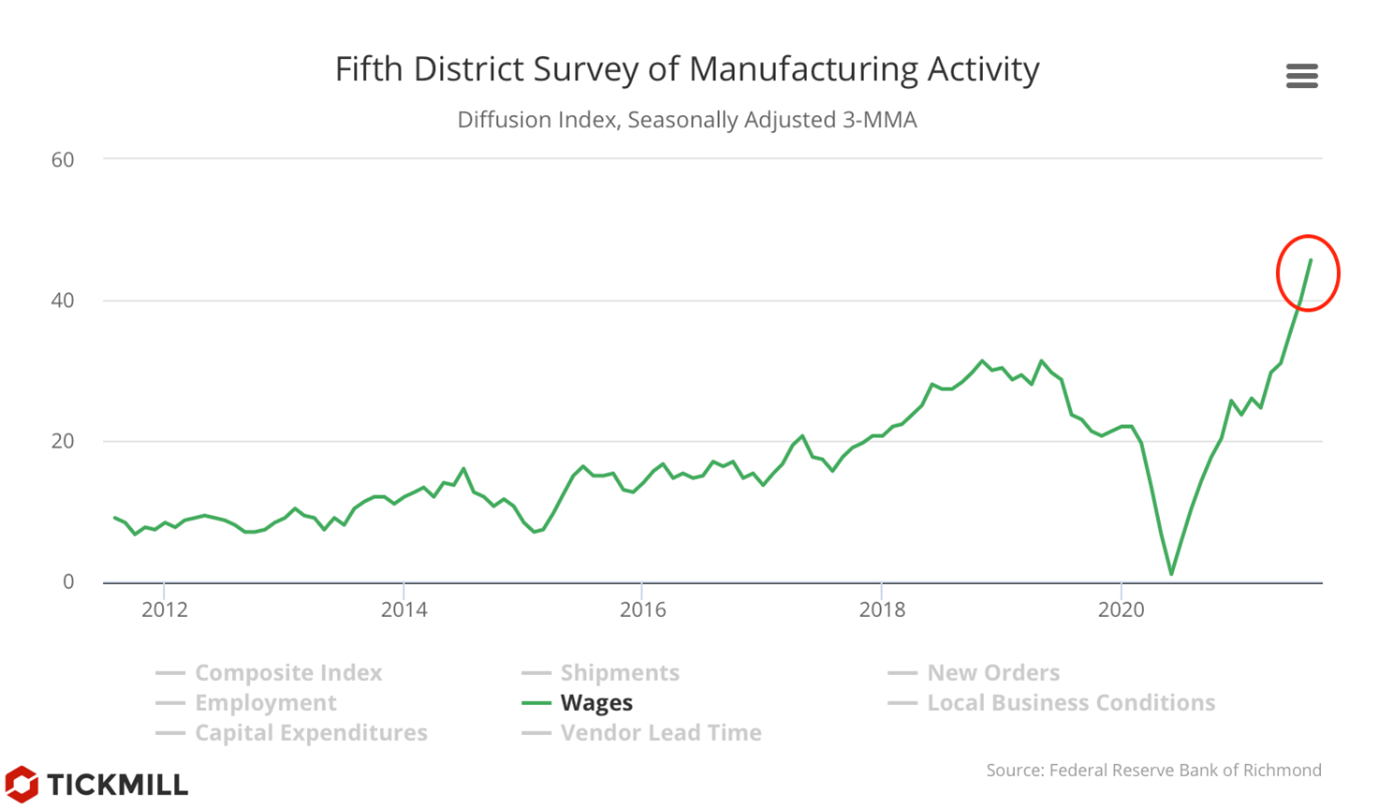

Richmond Fed report released yesterday showed that expansion in US manufacturing activity slowed in August. The index fell from 27 to 9 points missing the forecast of 25 points. The poll showed that firms increased hiring and wages in August as the pay index hit fresh record:

Firms reported that difficulties in finding workers persist and expect this to continue over the next six months.

The report basically shows that labor market shortages remained high in August and wage inflation is set to increase further, boosting hawkish outlook for August Non-Farm Payrolls report.

The US House of Representatives approved a $ 3.5 trillion budget resolution which should help to push through the $ 550 billion infrastructure spending package. This is good news for US growth prospects. The news also triggered a 4bp increase in 10-year risk-free rate to 1.294% as bond traders price in increasing pace of borrowing of the US Treasury.

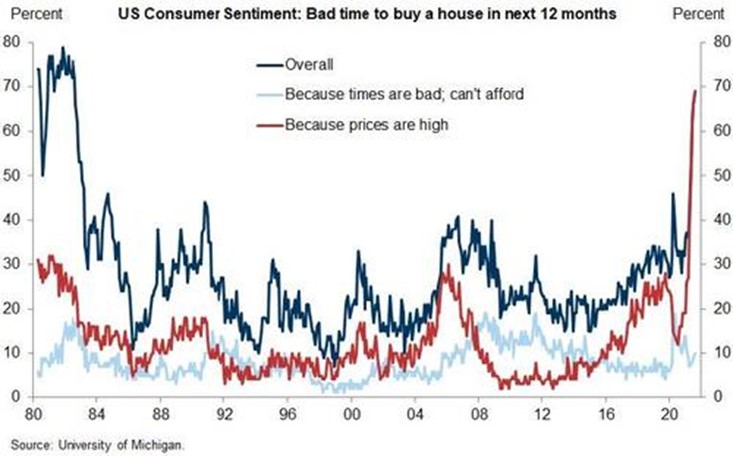

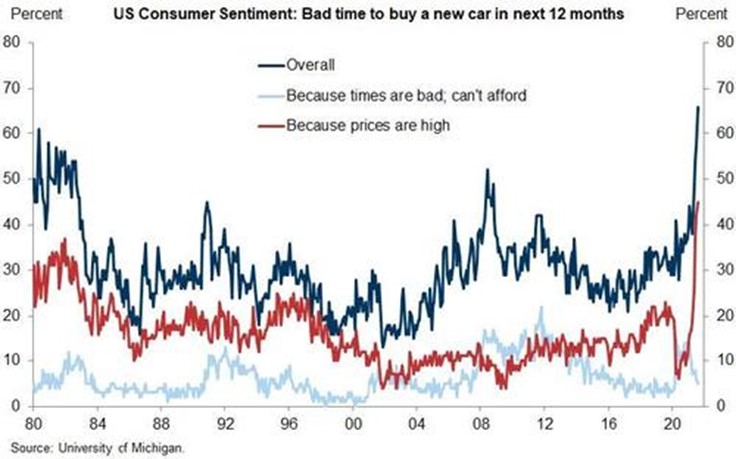

Markets mood remains positive albeit vulnerable to sharp shifts. Earlier this week, investors were pricing in a dovish bias in Powell Jackson Hole speech, i.e., little information on the timing of policy tightening or rebuttal of market suggestions that transition to policy normalization will begin in September. This was primarily caused by the slack in soft US PMI data as well as deterioration in consumer figures - retail sales and consumer sentiment index from U. Michigan. By the way, the consumer survey also showed that high prices deter consumers from purchasing cars and houses - the index of those who do not plan to buy a car and real estate in the next 12 months because of excessive price growth reached a record level:

The risk of decline in demand for long-term consumer goods and real estate in the United States suggests that a price correction is looming, so this can be one of the reasons why the Fed has less incentive to taper QE fast.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.