Daily Commodity Coverage: 25 Sep, Wednesday

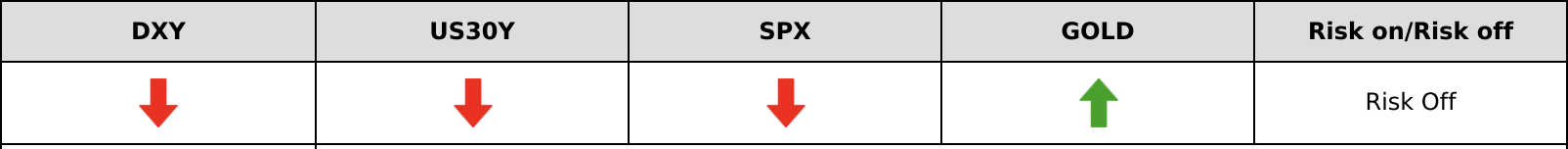

Asia stock market are poised for a drop after a disappointing U.S. session. The S&P 500 dropped 0.8%, its biggest one-day drop since Aug. 23, to 2,966.60.US Treasuries yields dropped after House Speaker Nancy Pelosi announced a formal impeachment inquiry into President Donald Trump.

Asia stock market are poised for a drop after a disappointing U.S. session. The S&P 500 dropped 0.8%, its biggest one-day drop since Aug. 23, to 2,966.60.US Treasuries yields dropped after House Speaker Nancy Pelosi announced a formal impeachment inquiry into President Donald Trump.

The House will start an impeachment inquiry into President Donald Trump as a swell of Democrats denounce the president over alleged abuses of power, House Speaker Nancy Pelosi said Tuesday. Concerns have mounted about the president’s efforts to push Ukraine to investigate the family of former Vice President Joe Biden, one of his top rivals for the presidency in 2020. Meanwhile, U.S. consumer confidence posted the biggest drop since the start of the year, posing a risk to the household spending that is underpinning growth for U.S. economy. Safe havens benefited from the new wave of risk aversion and USD dropped from recent high.

USDCHF

Technical Analysis:

Fundamental Analysis:

USDCHF | Bullish ↑ | ★☆☆

25 Sep: Same as JPY, CHF is driven higher as the political risks in the U.S. grow. On Monday there are reports that China has allowed some companies to buy millions of tons of US soybeans without import tariffs. This news bolstered hopes of a deal between the world's two largest economies and helped improve the global risk sentiment. But this optimism was overshadowed by U.S. political risks after Nancy Pelosi announced the House is launching a formal impeachment inquiry into President Trump, triggering concerns over the stability of the U.S. economy. Today we will have the Credit Suisse Economic Expectations, but is unlikely to impact CHF. CHF is likely to edge higher amid the dominating risk aversion.

NZDUSD

Technical Analysis:

Fundamental Analysis:

NZDUSD |Bullish ↑ | ★☆☆

25 Sep: The Kiwi drifted higher against the US Dollar during Asia's trading session this morning. This was in part thanks to disappointing numbers coming out of the the US consumer confidence report. Further, after RBA's governor Lowe mentioned that there are "some signs that, after a soft patch, the economy has reached a gentle turning point", the Kiwi got an additional boost. Domestically however, the recent release by RBNZ on trade balance showed that the trade balance for August did not meet expectations. Data came in at1565million against 1400million. This hardly make the Kiwi fall further as markets are in anticipation of the upcoming RBNZ main event. Market observers are anticipating yet another rate cut of 25bps. A rate cut now would also send the Kiwi to fall lower. However we note that a rate cut of 50bps was carried out earlier in anticipation of global economic events. As that was a pre-emptive action, and with global risk sentiment easing off we do not think RBNZ would call for another rate cut. We turn bullish on the Kiwi.

USDCAD

Technical Analysis:

Fundamental Analysis:

USDCAD | Neutral | ★☆☆

25 Sep: The Loonie dipped lower over night as oil prices similarly also faced downside pressure. However the CAD still held its ground against the US Dollar, finding support around the 1.324 region. The price of oil fell lower due to the data released by American Petroleum Institute (API). API estimated a surprise crude oil inventory build of 1.38 million barrels for the week ending September 19, compared to analyst expectations of a 768,000-barrel draw. While there are no major news today for the CAD, we continue to watch the developments in the oil and gas sector. We maintain our neutral bias for now.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Desmond Leong runs an award-winning research firm (The Technical Analyst finalists 2018/19/20 for Best FX and Equity Research) advising banks, brokers and hedge funds. Backed by a team of CFA, CMT, CFTe accredited traders, he takes on the market daily using a combination of technical and fundamental analysis.