Bullish Gold Outlook Remains Following FOMC

Gold Holds Support Post-FOMC

We failed to see any significant moves on the back of the FOMC yesterday. The Fed cut rates as expected and signalled more to come, though rate cut projections were slightly lower than the market was pricing in. Along with some warnings over inflation from Powell, USD was seen a little firmer on the back of the meeting causing some downside in gold.

Bearish USD/Bullish Gold View

However, once the dust settles, the consensus view is for USD to move lower as the impact of fresh Fed easing takes hold. Additionally, any incoming data weakness should bolster easing expectations putting greater pressure on USD, allowing room for gold to move higher again. In particular, any signa that the uptick in inflation is starting to cool should have a clear, bearish impact on USD alongside signs that the labour market remains weak or is weakening.

Risk Sentiment

Along with the impact of the FOMC and US data, traders are also keeping an eye on the various geopolitical situations still causing great uncertainty for markets. With conflict between Russia and Ukraine continuing and intensifying at time, fears of a spill over in NATO territory and elevated aggression from Israel in the Middle East, gold looks likely to retain residual safe-haven demand. Indeed, any fresh escalation in either of these situations should feed into higher gold demand near-term.

Technical Views

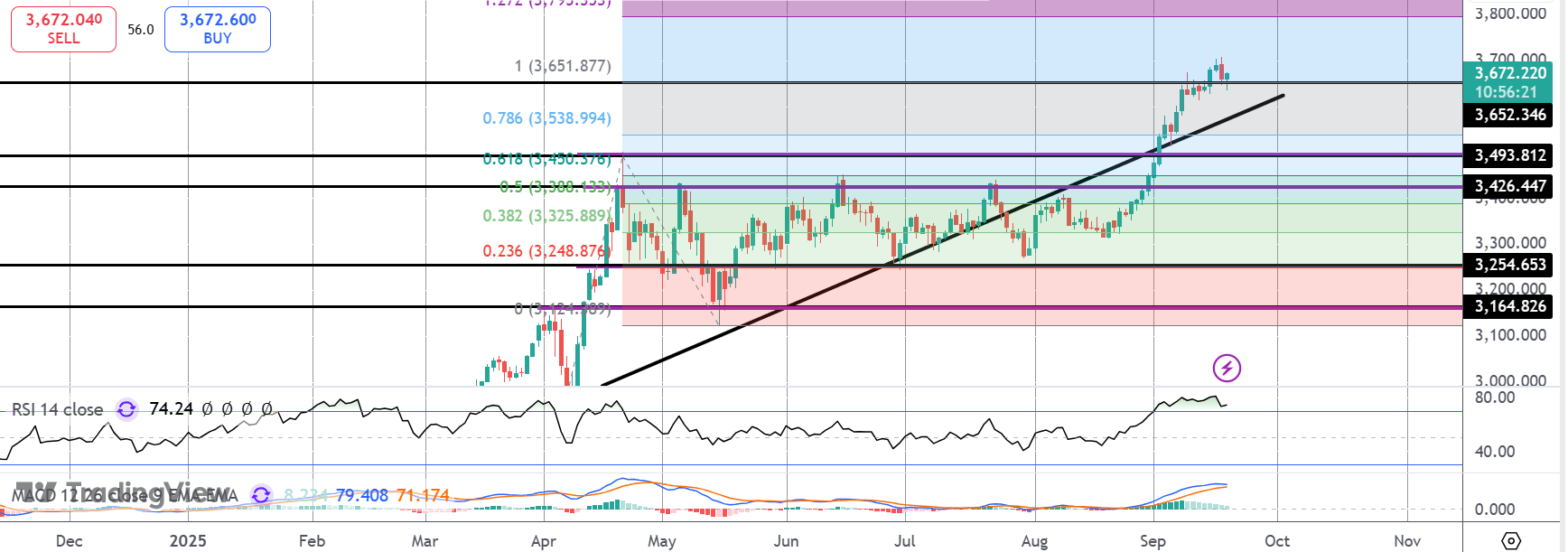

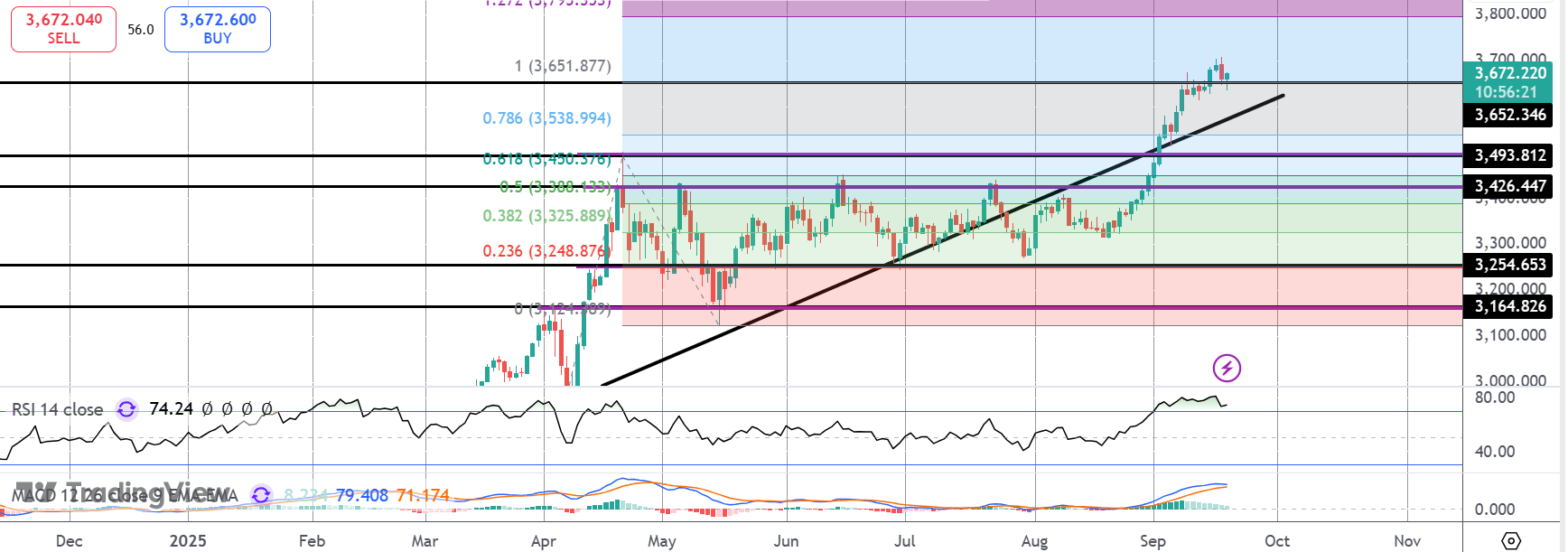

Gold

For now, gold remains atop the 3,652.34 level and back above the bull trend line. While supported by this, focus is on a continuation higher with 3,800 the next bull objective. To the downside, 3,493.81 will be the key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.