Breakout in USDJPY Could Signal new leg of the Bullish Rally with 7-year High as Target

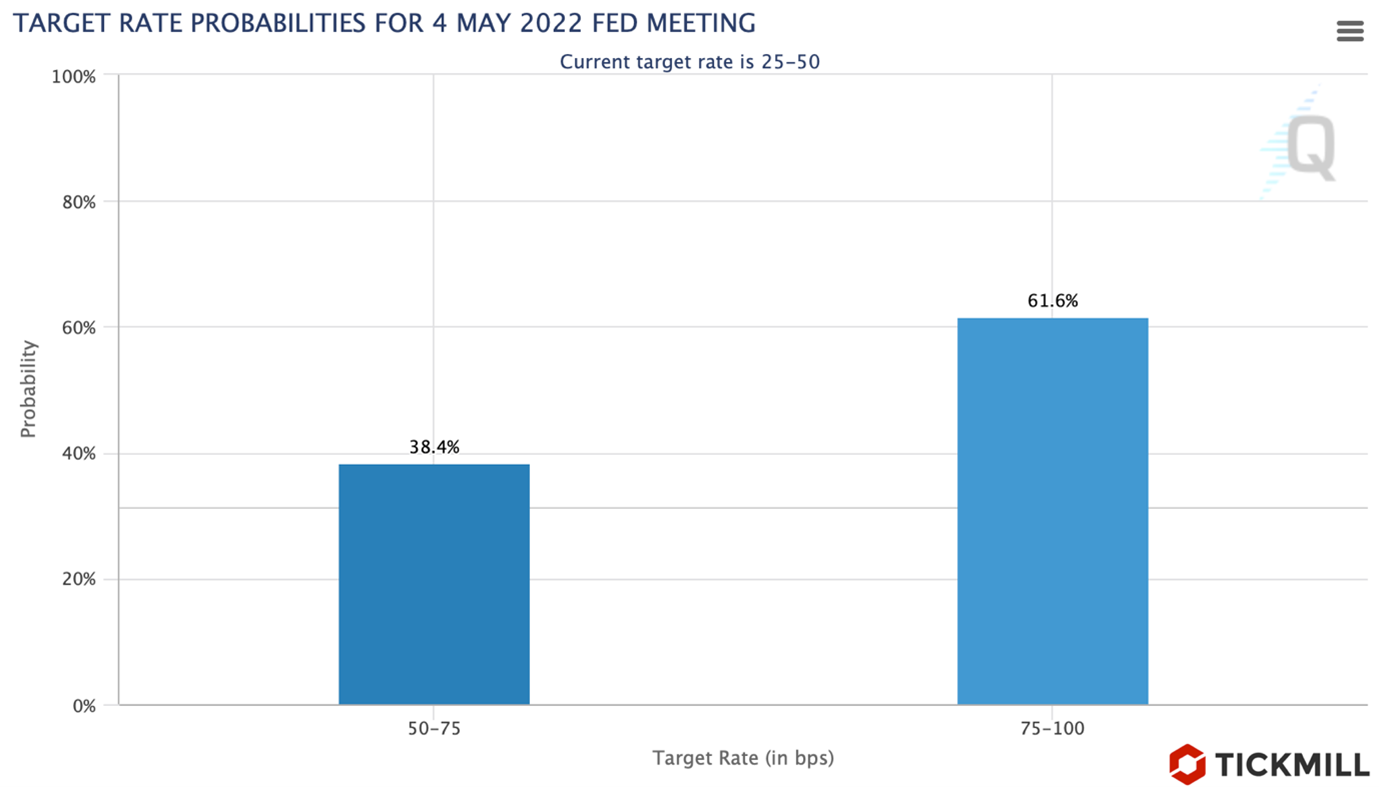

Powell's speech yesterday definitely impressed investors as the Fed Chair took the opportunity to communicate a possibility of faster rate hikes which was interpreted as the policy bias of the Fed getting more hawkish. Markets were quick to price in 50 bp hike on May as a baseline scenario, the odds of the outcome rose from 50% to 60%:

One of the Fed officials, James Bullard, said yesterday that it is appropriate to hike interest rate to 3% before the end of the year, market expectations center around 2.7%. New details from the Fed exacerbated US yield curve inversion – short-term Treasury yield rose so much that the spread between 10-year and 2-year bonds narrowed to 0.17%, reflecting increasing market concerns about the Fed’s policy error:

High oil prices are fueling speculations that the global economy will soon slide into recession. It is appropriate to recall the 80s when the then head of the Fed, Volcker, faced dilemma similar to Powell’s - an inflation shock due to high oil prices and the need to tighten policy. Then the rate was raised to 15%, which turned out to be excessive and plunged the US economy into recession. The dollar then rose significantly. Now the Fed has also set a course for tightening, and with each new statement the bar is getting higher.

The combination of high oil prices and increasingly hawkish Fed policy stance is a strong precondition for weakening of the Japanese yen. Today we see a significant rally in USDJPY by almost 1 percent. The status quo of the Bank of Japan increases risks of further collapse of the yen, it is quite possible that the breakout of 118.5 on USDJPY (the upper limit of the medium-term trend) and then 120, an important resistance level, should bolster speculations about a rally towards the 7-year high at 125:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.